Issues

I always seek to be a voice for all Texans – working for those without a lobbyist or political action committee, working for justice and change that makes a real difference in the lives of our neighbors. By listening, I seek to make the most important priorities of your family, my own priorities.

When your family is counting on something — affordable home prices or rent, child care, a good job, or secure retirement plan –we should not let big government get in your way, but neither should we let other powerful, profiteering forces interfere – like Wall Street banks, insurance monopolies, Elon Musk and his DOGE “Musketeers,” or predators taking advantage of the weak or vulnerable.

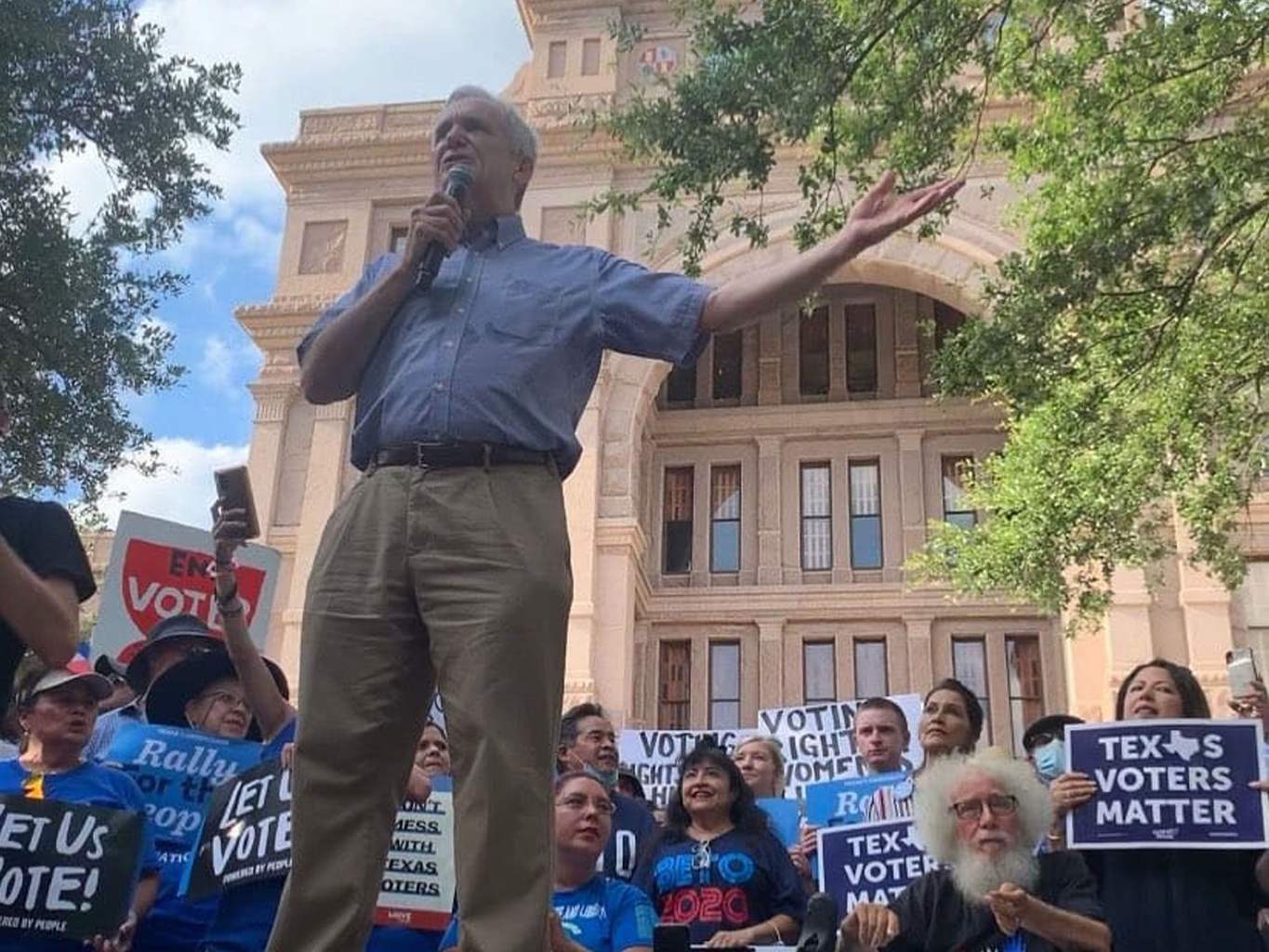

I am committed to fighting for equal rights for all Americans. Here in Texas, we are the #1 target of GOP voter suppression, and home to a movement to reinvigorate voting rights nationwide.

More than just defeating Trump, we must defeat Trumpism. We need to march, not just on the streets, but by finding ways in our daily lives to promote change. Abraham Lincoln is often quoted as saying, “Public sentiment is everything. With it, nothing can fail; against it, nothing can succeed. Whoever molds public sentiment goes deeper than he who enacts statutes or pronounces judicial decisions.” With energized, engaged citizens, who refuse to accept defeat, we will obtain the progress we seek.

Trump and his enablers are blocking any efforts to make progress. In fact, his Department of Justice canceled hundreds of grants to community organizations and local governments, that included funding for gun-violence prevention programs, crime-victim advocacy and even efforts to combat opioid addiction, When we had a Democratic majority in the House, I worked with my colleagues to pass H.R. 1446, background checks bill. But too many Republicans, backed by the gun lobby, continue to block action in the Senate. Republicans are making almost every place we go, schools, churches, entertainment venues, less safe. I am pleased to note that the NRA has consistently graded me with an “F.”

Trump and his enablers are blocking any efforts to make progress. In fact, his Department of Justice canceled hundreds of grants to community organizations and local governments, that included funding for gun-violence prevention programs, crime-victim advocacy and even efforts to combat opioid addiction, When we had a Democratic majority in the House, I worked with my colleagues to pass H.R. 1446, background checks bill. But too many Republicans, backed by the gun lobby, continue to block action in the Senate. Republicans are making almost every place we go, schools, churches, entertainment venues, less safe. I am pleased to note that the NRA has consistently graded me with an “F.”

Trump has already fired more military veterans than any president in history and has cut more than 2,400 from the Veterans Administration — sacking veterans who help other veterans. This means that for VA clinics, like the one I worked for so many years to get built in Austin, even longer wait times and understaffed veterans’ crisis and emergency dispatch hotlines. In a prior Congress, I helped passed legislation in the House, the Wounded Veteran Job Security Act, to ensure that wounded veterans returning from service are not forced to choose between keeping their job at home and getting needed treatment. As I visit with Texas veterans, I understand the need for prompt, nearby care, which is why I worked to expand veterans’ health facilities so Texas veterans don’t have to drive long distances for the basic health care they have earned. We must improve the VA, not slash its staff, not “privatize” it and certainly not dismantle it.

Trump has already fired more military veterans than any president in history and has cut more than 2,400 from the Veterans Administration — sacking veterans who help other veterans. This means that for VA clinics, like the one I worked for so many years to get built in Austin, even longer wait times and understaffed veterans’ crisis and emergency dispatch hotlines. In a prior Congress, I helped passed legislation in the House, the Wounded Veteran Job Security Act, to ensure that wounded veterans returning from service are not forced to choose between keeping their job at home and getting needed treatment. As I visit with Texas veterans, I understand the need for prompt, nearby care, which is why I worked to expand veterans’ health facilities so Texas veterans don’t have to drive long distances for the basic health care they have earned. We must improve the VA, not slash its staff, not “privatize” it and certainly not dismantle it.

I have also authored legislation to expand Medicare coverage to include hearing, vision, and dental care. Because I believe health care is a right, not a privilege, I support Medicare for All and endorse approaches to build toward that goal, including lowering the age for Medicare. I also filed the Stop the Wait Act, fighting for fairness for people with disabilities and ending burdensome waiting periods before collecting disability payments and receiving Medicare coverage.

As a member of the Congressional Reproductive Freedom Caucus, with a 100% pro-choice voting record, I oppose efforts to block access to comprehensive reproductive care and fully support measures that help protect women’s health. The Republican-controlled activist Supreme Court outrageously overturned five decades of precedent protecting the right to privacy and choice. This injustice must become the fuel for greater engagement to ensure that health care choices are made only by consulting a doctor and loved ones, not politicians or judges.

Our planet is at stake, now more than ever. Normally, Texas weather is either hot or hotter. Increasingly, we just have hotter. By the turn of the century, Texas can expect about 100 days that reach 100 degrees or more annually — what a world we are bequeathing to our children and grandchildren.

We need to act now at all levels to keep our world livable. Instead, Trump has stacked his cabinet with a clown car full of anti-science conspiracy theorists, fired independent EPA science advisors and other dedicated public servants and replaced with heel-clicking MAGA apologists.

In the past, I introduced the Green Transportation Act, which directs cities and states to reduce greenhouse gas emissions in the transportation sector, the single largest source of carbon pollution in the United States. Because many parts of the country are not accounting for transportation emissions, this represents an important step in seeking to reduce pollution by mandating the tracking of emissions and creation of local plans to reduce them, while providing federal support.

If we want to change the climate, we need to change the political climate. Withdrawal from the Paris Agreement was an historic mistake that Trump made twice. A warming planet will overwhelm our Gulf Coast, expand the Sonoran desert into much of Texas, and hasten the spread of disease. We need an agenda governed by sound science that truly reflects the consequences of inaction.

Our democracy, our elections, as Americans, are not for sale. We saw proof when, thanks to tremendous grassroots efforts, all Elon Musk bought in 2025 with his $26 million was a photo-op with one very expensive cheese hat as Wisconsin voters showed they were not for sale. As a sponsor of several campaign finance reform bills, including, in a prior Congress, House Democrats’ broad reform package, H.R. 1, I am working to reform a political system awash with secret corporate money, which distorts congressional priorities. We will not be able to enact real reform on a number of fronts until we pass effective campaign finance laws. I have supported a constitutional amendment to reverse the Supreme Court’s wrongly-decided Citizens United opinion.

If it is worth doing, it is worth paying for. The Republican bills are taking a wrecking ball to our economy. I have been a strong advocate of tax reform, including tax law simplification and protecting individuals and small businesses from bearing the burden dodged by multinational corporations.

I voted against all the Trump-GOP tax schemes because they hurt middle-class families and give giant multinationals tax breaks for shipping jobs abroad and hiding profits in offshore tax havens. The Joint Committee on Taxation – Congress’ official, nonpartisan tax scorekeeper – found in the first year after the Republican tax law multinationals paid an effective tax rate of just 7.8%. That’s far less than the percentage paid by a teacher, firefighter, or nurse.

To level the playing field, I authored legislation – the “No Tax Breaks for Outsourcing” Act – to ensure big corporations do not get a tax break for shipping jobs overseas and to close the loopholes that let multinationals book profits from selling to American consumers in an offshore haven. President Biden included key elements of my bill in his Build Back Better Act to end these incentives for outsourcing, making the tax code fairer for workers and businesses in the United States.

I am a strong supporter of the expanded Child Tax Credit, which lessens the tax burden for working families and has helped to lift so many children out of poverty. We passed this relief as part of the American Rescue Plan, and at that time it slashed child poverty by almost 30%. These are the investments we can make in our future by requiring multinational corporations and the very wealthiest few to simply pay their fair share.

As one of the senior Democrats on the House Ways and Means Committee, I successfully authored the “Protect Our Kids Act,” which created the National Commission to Eliminate Child Abuse and Neglect. After holding its first field hearing in Texas at my request, the Commission held field hearings around the country to create a coordinated national strategy to ensure every child has a happy, healthy upbringing and earlier this year, released its comprehensive report. For my efforts, I was honored with the Congressional Champion for Real and Lasting Change Award from Save the Children.

As one of the senior Democrats on the House Ways and Means Committee, I successfully authored the “Protect Our Kids Act,” which created the National Commission to Eliminate Child Abuse and Neglect. After holding its first field hearing in Texas at my request, the Commission held field hearings around the country to create a coordinated national strategy to ensure every child has a happy, healthy upbringing and earlier this year, released its comprehensive report. For my efforts, I was honored with the Congressional Champion for Real and Lasting Change Award from Save the Children.

During both of Trump’s terms, my vote was always: not one more dime for Trump’s wretched anti-immigrant policies. What we’re witnessing is not law enforcement—it’s lawless. Reports from across Texas—including right here in Austin—describe agents targeting schools, harassing people without warrants, and detaining individuals without due process. No one should have to live in fear of dropping their child off at school or visiting a hospital.

We are a nation of immigrants and immigration has always made us stronger. Immigration reform will grow our economy as more individuals can fully participate in our economy and more students complete their education. It will also continue to culturally enrich our state and country. Passing comprehensive immigration reform should have been accomplished years ago, but remains stalled with the Republican hold in Congress and the White House. In addition to blocking progress on the Dream and Promise Act, Republicans have introduced a string of anti-immigrant bills. As a consistent sponsor of the Dream and Promise Act, I am fighting not only for a secure future for these Americans in all but a piece of paper, but also for broader immigration justice for the many more who have been barred from applying for citizenship for far too long.

As we work to rectify the injustices of Trump’s cruel and inhuman treatment of immigrants, we must keep hope alive in our work striving for a just, humane immigration system.

As the Chair and Founder of the House Affordable Prescription Drug Task Force, I am committed to bringing more oversight and transparency to drug pricing and supporting legislative and administrative solutions so that more families can afford the medicine they need. Because of pharmaceutical price gouging, a diagnosis of cancer or other dreaded disease or condition is too often a prognosis for financial ruin or hardship, even for those who have insurance. When I was still Chair of the Health Subcommittee (and will be again when the Democrats retake the House in 2006), the first hearing I held was to address the topic of rising drug costs. I authored the Medicare Negotiation and Competitive Licensing Act, the most comprehensive and bold prescription drug reform legislation in Congress, which has been endorsed by the Congressional Progressive Caucus and dozens of consumer groups. At Senator Sanders’s request, I also filed companion legislation to his Medicare Drug Price Negotiation Act and have partnered with him for years in working to rein in Big Pharma monopoly power.

I have filed several other bills to shed light on the cost of development and pricing practices, to end pay-for-delay deals, and filed a bill with Senator Warren to ensure reasonable prices on taxpayer-funded drugs. After all, an unaffordable drug is 100% ineffective.

Under Trump, markets are crashing and prices are rising, even as your retirement nest egg faces many threats. I am working to ensure seniors can enjoy a safe and healthy retirement that they worked a lifetime to earn. AARP honored me with its Champion Legislative Leadership Award. for my efforts to strengthen seniors’ access to healthcare. In the wake of the 1929 stock market crash and bank failures, President Franklin Roosevelt actually understood how to “Make America Great Again.” It wasn’t through stirring hate or fear mongering; he didn’t settle for the “every person for themself” approach. Instead, he established that pillar of retirement safety, Social Security. In more than eight decades, Social Security has never been a day late or a dollar short.

Despite these benefits, the drive to dismantle Social Security remains a real threat. Some see privatization as an option, a tantalizing prize for a host of Wall Street financial interests. But privatizing will only reduce solvency and endanger benefits for millions of current beneficiaries.

My longstanding efforts to remove Social Security numbers from Medicare cards were finally successful. The Medicare Identity Theft Prevention Act will ensure more seniors are protected from identity theft.

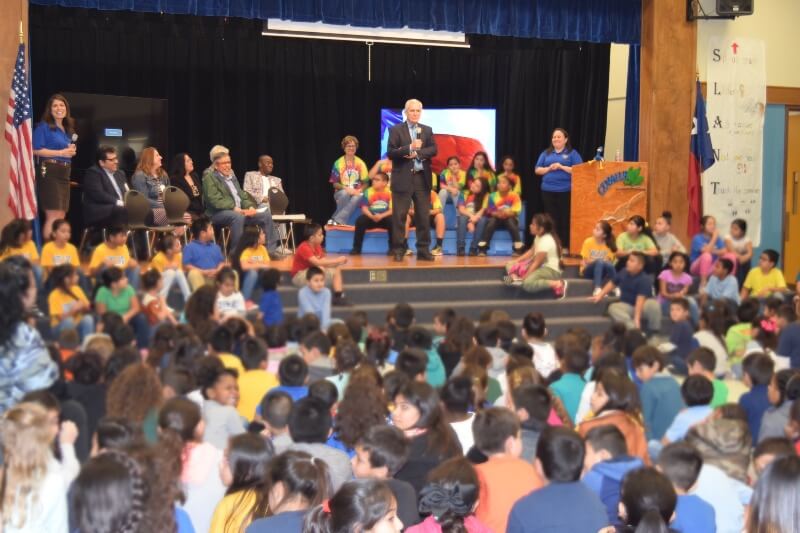

As a product of Austin public schools and as a father and grandfather of successful AISD students, I know the value dedicated educators bring to our community. My wife Libby was a bilingual education teacher and served in the Department of Education during the Obama Administration. We know our public schools are vital for both individual opportunity and our continued economic promise. During the consideration of the Republican Budget in February, which will slash funding for millions of Americans in order to provide tax cuts for billionaires, I offered an amendment to preserve the Department by protecting critical funding. Students should be able to receive all the education for which they are willing to work. Our economy and democracy depend on it.

public schools and as a father and grandfather of successful AISD students, I know the value dedicated educators bring to our community. My wife Libby was a bilingual education teacher and served in the Department of Education during the Obama Administration. We know our public schools are vital for both individual opportunity and our continued economic promise. During the consideration of the Republican Budget in February, which will slash funding for millions of Americans in order to provide tax cuts for billionaires, I offered an amendment to preserve the Department by protecting critical funding. Students should be able to receive all the education for which they are willing to work. Our economy and democracy depend on it.

I helped pass the successful American Opportunity Tax Credit (AOTC) that provides up to $10,000 over four years to reimburse higher education expenses for students and their families. For the first time since higher education tax credits were created, my tax cut expanded the definition of a “qualified education expense” to include textbooks, making them more affordable. I also introduced a bill removing a major financial and logistical barrier to students securing higher education opportunities. My Tax Free Pell Grants Act expands the usage of Pell Grants on a tax-free basis and improves coordination with the AOTC.

As a strong advocate for student debt reduction, my work has resulted in simplifying the Free Application for Federal Student Aid (FAFSA). Students and their families may now use earlier tax data to complete the FAFSA, and the form is now available in October instead of January.

Small businesses are the driving force in our Nation’s economy and we need to clear the highway for them, I have supported legislation making it easier for small businesses to raise capital and cut some of the red tape that makes it harder for start-ups to get off the ground. Meanwhile Trump’s on again, off again tariffs are driving small businesses into the ground.

I have voted against tax schemes that favor multinationals at the expense of small businesses — I seek a level playing field.

The New Markets Tax Credit is another important tool for attracting capital to underserved communities that badly need it. As a member of the Congressional STEM Education Caucus, I know the key role that science, technology, engineering, and math play in enabling the U.S. to remain the economic and technological leader globally.

Finally, on behalf of small business and entrepreneurs locally, I work to obtain federal funding to supplement important local efforts. I voted for several relief packages during COVID that provided support for our local small businesses, including musicians and music venues.

The morning after Russia’s invasion of Ukraine began, I authored legislation to expel Russia from the World Trade Organization and strip it of preferred trade status. The measure eventually passed and was signed into law six weeks later, along with my bill banning Russian energy. As Putin’s atrocities continued, I supported congressional action to provide billions in immediate aid. I also questioned the Ukrainian Prosecutor General about Russian War Crimes in a special hearing convened in the same Nuremberg, Germany courtroom in which Nazi war criminals were once tried. In 2024, I introduced a comprehensive legislative package with colleagues that includes two provisions I authored to strengthen the current ban on Russian petroleum products laundered into the United States and leverage frozen Russian sovereign assets to establish a reconstruction fund for Ukraine. Ukraine, as it fights for its sovereignty, deserves our support.

Civil Rights

Civil Rights Resisting Trump, Musk and their GOP Enablers

Resisting Trump, Musk and their GOP Enablers Passing Common-Sense Gun Legislation

Passing Common-Sense Gun Legislation Serving Those Who Protect Us: Our Veterans

Serving Those Who Protect Us: Our Veterans Promoting Healthcare and Reproductive Freedom

Promoting Healthcare and Reproductive Freedom Climate Crisis

Climate Crisis Enacting Campaign Finance Reform

Enacting Campaign Finance Reform Closing Corporate Tax Loopholes and Policing Wall Street

Closing Corporate Tax Loopholes and Policing Wall Street Protecting Vulnerable Children

Protecting Vulnerable Children Pro-Family Immigration

Pro-Family Immigration Lowering the Price of Prescription Drugs

Lowering the Price of Prescription Drugs Retirement Security

Retirement Security Supporting Education

Supporting Education Helping Small Businesses and Tech Entrepreneurs Succeed

Helping Small Businesses and Tech Entrepreneurs Succeed Support for Ukraine

Support for Ukraine